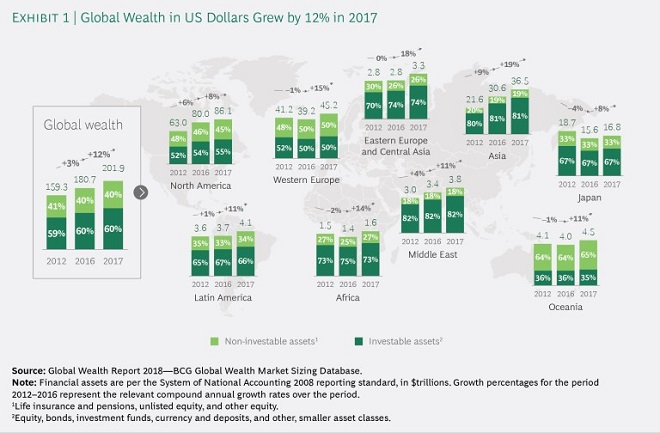

According to a report released by the Boston Consulting Group on June 14, 2018, the global personal financial wealth grew by 12 percent in 2017 to $201.9 trillion. The growth rate was almost triple the rate a year before at 4 percent.

The most significant driver of the growth is the bullish market in major economies, which results in substantial increase in equities and investment funds.

The growth of personal financial wealth also reflected in the offshore world. The wealth held offshore was accounted for $8.2 trillion - that's 6 percent growth compared to the last year's figure.

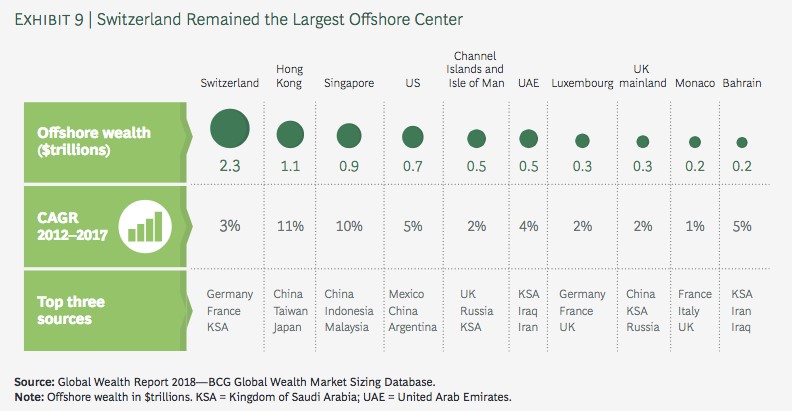

Switzerland, against all the odds, was still the largest offshore jurisdiction of all, managing $2.3 trillion of global funds. In other words, Switzerland manages almost a third of global offshore wealth. That's a respectable figure.

What gives? How does Switzerland maintain its status quo in the offshore world? Read on to learn more about the most recent trends in offshore personal wealth management.

The demise of Switzerland as an offshore wealth destination

With all the news and talks you can access freely online, you can't help to get the impression that the death of offshore wealth management is certain. The demise of top offshore jurisdictions in the financial world seems to be apparent: Switzerland, the "brand name" for offshore wealth protection is said to be dead. Singapore and Hong Kong, two best offshore financial centers in Asia, are said to be in decline.

Many would argue that the AEoI/CRS, FATCA and all tax transparency initiatives that aim to reveal asset holders' information are considered as a success. The media, at least, claims that to be the case.

The thing is, studies and researches reveal that popular (read: managing huge asset values) offshore jurisdictions are still "competent enough" to aid clients' wealth planning.

The contradictions in the media can tell us about one thing: We know that offshore asset protection is alive and well. Switzerland is an excellent indicator of this.

Switzerland as an offshore destination: Alive and well

Switzerland signed the AEoI (Automatic Exchange of Information) agreement with 40 countries - and counting. This might be viewed as the end of Switzerland's secrecy - something that the media is clamoring about - but not the entire offshore sector in the country.

In fact, wealth in Switzerland is no longer synonymous with tax evasion, as many of the funds in the jurisdiction are for asset protection and investing.

According to the same report, Switzerland is still the most important jurisdiction in the offshore world, managing $2.3 trillion in personal wealth, followed by Hong Kong at $1.1 trillion and Singapore ($0.9 trillion), respectively.

While the differences are quite overwhelming, it's important to note that Switzerland's growth was slowing down to 3 percent, compared to Hong Kong's 11 percent and Singapore's 10 percent of growth rate.

The growth rates above mean that, if the trends continue, Hong Kong and Singapore will catch up, eventually.

Where is the USA?

Most of the offshore wealth is originating from the North American residents, most notably the USA. It's accounted for 40 percent of the total, well ahead the asset holders from Western Europe (22 percent.) However, not many realize that USA - as a jurisdiction - is a prominent player in global asset protection.

USA - allegedly the strongest offshore jurisdiction of all since it's not doing the information exchange with other countries - is catching up, with the offshore wealth managed were accounted for $0.7 trillion at 5 percent growth rate. This ranked the US at number 4 behind Switzerland, Hong Kong, and Singapore.

There's a "caveat" in this, however. The BCG report highlights wealth managed offshore, which ruled out the US - which is technically the onshore jurisdiction for US' asset holders.

If we define "offshore" as a jurisdiction which offers privacy and low taxation, the US turned out to be the largest in the world. With "offshore" jurisdictions like Delaware (with hundreds of thousands of companies registered) and Wyoming (popular among small businesses), which laws allow asset holders to set up a company and keep their assets from the tax authorities - legally, the US will become the top destination for both onshore and offshore wealth protection in the near future.

The key holders to growth: Wealth managers' value propositions

Anna Zakrzewski, a BCG partner and the co-author of the report, explained that although the figure is seemingly significant, the tightening regulations on offshore asset protection has successfully push asset owners - especially the lower high-net-worth asset holders - to take their funds back onshore. However, the significant inflow of funds to offshore centers driven by new services offered by financial institutions offset the decline.

The data collected from 150 wealth managers worldwide revealed that the wealth management firms were projected to grow their revenue by from 8 percent to 12 percent, mainly driven by smart pricing and, of course, the acquisition of new clients.

Switzerland, one of the biggest conduit offshore financial centers in the world, is a popular jurisdiction among the wealth managers - thanks to the sound banking systems.

What's in the future?

The offshore wealth will continue to rise at the rate of 5 percent per year over the next five years.

Wealth managers remain the principal holders of the growth. Their ability to identify opportunities and address challenges - and craft financial products and services based on those - will profoundly influence the future of offshore asset protection.

For Switzerland, wealth managers play even a more significant role in its ability to survive the competition.

For more briefings, including identifying the jurisdictions for your asset protection plan, you can consult with us.

JUN

2018

Table of Contents